Has Nuclear Energy's Time Come?

Growing demand for carbon-free energy has put nuclear back in the spotlight, but hurdles to new development remain

Last year, Baltimore-based Constellation Energy Corp. announced it would be restarting the undamaged reactor at the Three Mile Island Nuclear Generating Station in Pennsylvania. The site is famous for a partial reactor meltdown in 1979 that raised public concerns about the safety of nuclear energy. Perhaps less well known is that only one of the two reactors at Three Mile Island suffered damage during that incident. Unit 1 continued operating safely for decades and only shut down in 2019 due to cost considerations. Now, thanks to growing demand for reliable carbon-free energy, owner Constellation Energy is rethinking that decision.

For the last three decades, new nuclear power projects have been sparse. Things looked poised to change in the early 2000s when concerns about climate change and rising natural gas prices led to predictions of a nuclear energy revival. Energy companies applied for permits to build two dozen new nuclear reactors. But the 2007-2009 recession squashed both economic growth and energy demand, advances in fracking during the 2010s greatly reduced natural gas prices, and damage to the Fukushima Daiichi Nuclear Plant in Japan following a tsunami in 2011 reignited global safety concerns about nuclear energy. In the end, only four of the 24 planned new reactors proceeded to the construction phase: two reactors in Burke County, Ga., and two in Fairfield County, S.C. (See "Nuclear Reactions," Econ Focus, First Quarter 2016.) Both projects ran into numerous delays and cost overruns. Construction in South Carolina ultimately stalled in 2017, and the Georgia reactors were finally completed in 2024 at a cost of more than double initial estimates.

Today, technology companies investing in artificial intelligence (AI) are scrambling to secure clean energy to power their data center expansions. Indeed, Constellation Energy's decision to restart Unit 1 at Three Mile Island was driven by such an agreement with Microsoft. Environmental considerations have renewed interest in nuclear energy as well. In 2023, more than 20 countries (including the United States) pledged to triple nuclear energy capacity by 2050 to reach net-zero greenhouse gas emissions. Major tech companies, including Amazon, Meta, and Google, recently signed on to the same pledge. Has nuclear power's moment finally arrived — again?

Surging Demand

The growing electricity demand from the technology sector is a key reason for the renewed sense of optimism about nuclear energy.

"One of the major differences between now and the last nuclear renaissance is the support of all the major tech companies," says Aaron Ruby, director of Virginia and offshore wind media at Dominion Energy, a utility company whose service area includes Virginia, North Carolina, and South Carolina. "When people were talking about a nuclear energy renaissance 25 years ago, the tech sector didn't exist as it does today."

The growth of "Data Center Alley" in Northern Virginia exemplifies this rapid change. The region's proximity to Washington, D.C., and early internet infrastructure made it an attractive spot for some of the first large-scale commercial data centers in the late 1990s. (See "Virginia's Data Centers and Economic Development," Econ Focus, Second Quarter 2023.) Today, Virginia has around 150 data center sites, with 80 percent of them concentrated in three northern counties: Loudoun, Prince William, and Fairfax. Collectively, Virginia's data centers consume about 5,050 megawatts of electricity, or enough to power around 2 million homes. Despite this, energy demand in the state stayed largely flat from 2006 to 2020, according to a 2024 report from the Virginia Joint Legislative Audit and Review Commission (JLARC). This is because the increased demand was offset by efficiency gains elsewhere — but that dynamic is now set to change.

"We expect to see a doubling of our power demand over the next 15 years," says Timothy Eberly, a senior communications specialist at Dominion Energy. "When it comes to data centers specifically, we expect power demand to quadruple. It's the largest growth in demand we've seen since World War II."

The authors of the 2024 JLARC report came to similar conclusions, predicting that energy demand in Virginia will double within the next decade if all the necessary infrastructure for supplying that power can be built. This is largely due to the investments tech companies are making in AI applications that can answer questions and compose writing, art, photos, music, and videos all in response to user requests. These applications use power-hungry computer chips to quickly analyze enormous stores of data. According to a 2024 white paper from the Electric Power Research Institute, a nonprofit think tank, processing a request through ChatGPT (a popular AI application developed by OpenAI) takes 10 times the electricity of a traditional Google search. A December 2024 report from Lawrence Berkeley National Laboratory estimated that AI could cause the share of total U.S. energy consumption used by data centers to reach as high as 12 percent by 2028, compared to 4.4 percent in 2023.

"Over the last five years, we've connected nearly 100 data centers to the grid," says Eberly. "Not only are we connecting more of them, they're also getting larger. Five years ago, a typical data center might request 30 megawatts for full operation. Now, we're seeing requests for two or three times that amount and sometimes over 100 megawatts."

The growing electrification of vehicles and household appliances such as HVAC systems are also contributing to higher expected future energy demand. At the same time, many states have set goals to reduce reliance on fossil fuels for energy in the coming decades. Tech companies building new data centers have announced their own clean energy goals as well. Nuclear, with its sizeable and consistent energy output and zero carbon emissions, seems uniquely positioned to meet both growing energy demand and clean energy goals.

On average, a nuclear power plant can operate at full capacity around 93 percent of the time, making it a much more reliable source of energy than other carbon-free options. Wind power operates at full capacity around 36 percent of the time and solar power about 25 percent of the time. Because of this reliability gap, attempting to achieve decarbonization using only renewable energy and battery technology would be more expensive than using a mix of renewable and nuclear energy, according to a 2024 report by the U.S. Department of Energy (DOE). Additionally, nuclear power may be particularly well suited to replacing coal power plants. A 2022 DOE study of 237 coal plants found that 80 percent of coal plant sites have the necessary characteristics to be converted into nuclear power sites.

"Data centers want reliable, around-the-clock power with zero emissions, and there's only one source of power that offers that," says Ruby.

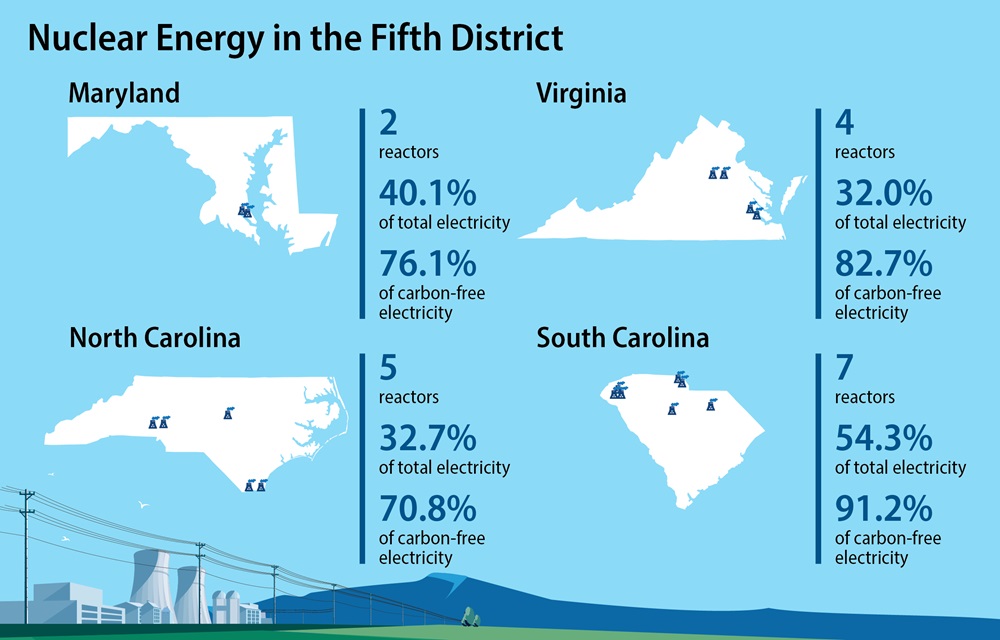

Nuclear energy provides about 20 percent of electricity in the United States, but close to 50 percent of carbon-free power. These shares are even higher for most Fifth District states. (See graphic.) But tripling nuclear capacity by 2050, as the United States and other nations pledged to do in 2023, would mean building around 200 additional reactors — a daunting task for a country that has only started and completed two in the last three decades.

Hurdles to New Construction

One of the bottlenecks confronting nuclear projects is the lack of trained workers. With decades passing between projects, many have retired or transitioned to new fields. To triple nuclear energy capacity by 2050, the DOE says the United States would also need to more than triple its nuclear workforce. But training new nuclear engineers takes years, and the number of programs equipped to do so has nosedived since the industry's heyday.

"When I started graduate school in nuclear engineering in 1978, there were nearly 100 such programs in the United States," says Alireza Haghighat, director of the nuclear engineering program at Virginia Tech. "Today, there are around 30. If we want to build the next generation of nuclear power technology in the United States, we have to provide the necessary environment and resources for our engineers and scientists."

In its 2024 report, the DOE notes that the industry could capitalize on the roughly 30,000 workers trained in the course of completing the two reactors in Georgia. And when it comes to actually running new nuclear plants, some experts have suggested that workers in plants using other energy sources, like coal, could be retrained to be a part of the nuclear workforce. Nuclear reactors currently operating in the United States use fission to heat water and produce steam that moves a turbine to generate electricity. The second part of that process is similar to how other types of power plants convert heat into energy, meaning there would be some overlap in the skills needed to oversee that portion of the operation.

But taking advantage of the knowledge and supply chains developed for the Georgia reactors would require companies to greenlight new projects quickly, and moving quickly has not been the industry's strong suit. Regulatory oversight is another source of delays for new nuclear energy plants. All reactor designs must obtain approval from the U.S. Nuclear Regulatory Commission (NRC) before any construction can even begin.

"There's a reason why the NRC is so thorough," says Anna Erickson, a professor of nuclear engineering at Georgia Tech. "Reactors have much higher safety standards now than before 1979. The flip side of that is that companies looking to license new reactor technologies face significant delays, raising the barrier to entry."

Many experts like Erickson and Haghighat have called on the industry to coalesce around a small number of already approved designs, such as the AP1000 reactor designed by Westinghouse and used in both the recent Georgia and South Carolina projects. This would, in theory, shorten the time for regulatory approval and allow firms to move more quickly to construction. But this has proven difficult for the industry in practice, both here and in Europe. Even reactors on the same site have slight differences, making each build unique from start to finish.

"Cost is a function of how scalable the process is," says Erickson. "The costs are enormous the first time you build something, and if you only build it once, you have no opportunity to reduce costs."

Promises of New Technology

One of the reasons the industry has struggled to coalesce around a single design is that the technology continues to evolve, and new designs hold the promise of solving other challenges that have held the sector back. Although nuclear power is relatively cost efficient once it is up and running, the upfront costs of building a new reactor are substantial. This increases the risks for investors should the project fail to finish, reducing incentives to begin the work in the first place. A relatively new class of nuclear power generators known as small modular reactors (SMRs) promise to come in much cheaper.

As their name suggests, SMRs are smaller than the types of nuclear reactors operating in the United States today, in terms of both energy output and physical footprint. The "modular" in the name refers to the fact that the components needed to build the unit are standardized and can be built at a factory, reducing the time and cost of construction. Many SMRs also use passive features for cooling, meaning they don't require a backup power source to ensure safety in the event of an emergency.

Although the underlying technology is not entirely new — it is similar to the types of nuclear engines that have powered submarines and other ships for decades — it has yet to be used for commercial power generation in the United States. In 2023, an SMR design by Oregon-based NuScale Power became the first in the country to be certified by the NRC. In Virginia, Dominion has begun exploring the possibility of adding SMRs to its North Anna nuclear site in Lousia County, and last October it entered into an agreement with Amazon to explore SMR development in the state.

"We're still in the exploratory phase of SMRs right now, so even if we did move forward, Virginians likely wouldn't see an operational SMR for another decade," cautions Dominion's Eberly.

Companies are also exploring reactor designs that utilize different cooling methods and fuels. Some types of nuclear fuel are more efficient, which could allow reactors to operate for even longer stretches of time, and some fuel types have better safety features that allow them to withstand higher temperatures. However, the United States currently lacks a domestic supply chain for the high-assay low-enriched uranium fuel required for these advanced reactor designs. Last October, the DOE awarded contracts to six companies to start building those supply chains.

In addition to advances in nuclear fission technology, companies are also racing to develop commercially viable nuclear fusion plants. Nuclear fusion replicates the energy-generating process of stars, combining atoms rather than splitting them apart. It offers an even cleaner source of reliable power, since no radioactive waste is produced by the process, but scientists have not found a way to sustain a large-scale fusion reaction that generates enough energy to be commercially viable. Commonwealth Fusion Systems, a Massachusetts-based company, claims to have solved this problem using an array of powerful magnets. It is building a test reactor at its campus in Massachusetts that is scheduled to be completed in 2027. Late last year, it announced the site of its first planned commercial fusion reactor: James River Industrial Park in Chesterfield County, Va., outside Richmond. Assuming the test is successful, Commonwealth says it expects to build the operational plant in the 2030s. Still, many experts remain skeptical.

"The saying in the industry is that fusion is a technology that's always 30 years away," says Erickson. While she thinks the magnetically confined approach being researched by Commonwealth is probably closer to reaching commercial energy production than other methods, the technology is unlikely to be in a position to scale up fast enough to meet energy demand over the next 10 to 15 years.

Inflection Point?

Can new nuclear capacity come online fast enough to meet expected demand over the next decade? So far, utility companies have focused on extending the life of existing reactors or even bringing decommissioned ones, like Three Mile Island, back into service. The latter comes with its own set of costs and delays. Constellation Energy expects to pay $1.6 billion to get Unit 1 at Three Mile Island back up and running by 2028. Until now, the United States has never reopened fully shut reactors that were in the process of being decommissioned. While active reactors periodically go offline to conduct maintenance and refuel, decommissioning a nuclear reactor is an expensive and lengthy process that takes 15 to 20 years. In Virginia, Dominion Energy announced last year that it had received approval from the NRC for a second 20-year extension for the two nuclear reactors at the North Anna Power Station.

When it comes to tripling nuclear energy capacity by the middle of the century, experts like Haghighat worry the United States is already behind in making the necessary investments. Recognizing these uncertainties, utilities and tech companies have also announced plans to meet the data center energy demand by expanding natural gas power capacity.

Other factors could also change the equation on power demand in the coming years. Earlier this year, Chinese company DeepSeek made headlines by launching a generative AI model that they claimed performed as well or better than American competitors but was more efficient. It's possible, then, that AI applications could require less electricity than initially thought, but it's too early to tell. Many experts still expect that energy demand will grow as the economy continues to find more uses for data.

"Data has become a utility," says Erickson. "To keep growing the applications for data, like AI, we need to supply the energy."

Readings

"Data Centers in Virginia." Joint Legislative Audit and Review Commission Report to the Governor and the General Assembly of Virginia, Dec. 9, 2024.

"Pathways to Commercial Liftoff: Advanced Nuclear." U.S. Department of Energy, September 2024.

"Powering Intelligence: Analyzing Artificial Intelligence and Data Center Energy Consumption." Electric Power Research Institute White Paper, May 28, 2024.

Shehabi, Arman, Sarah J. Smith, Alex Hubbard, Alex Newkirk, Nuoa Lei, Md Abu Bakar Siddik, Billie Holecek, Jonathan Koomey, Eric Masanet, and Dale Sartor. "2024 United States Data Center Energy Usage Report." Lawrence Berkeley National Laboratory, December 2024.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.