Join the Federal Reserve CDFI Survey and help us better understand how CDFIs serve their customers and their communities.

Taking Stock of Community Development Financial Institutions

Introduction

Community development financial institutions (CDFIs) are mission-driven organizations that expand financial product and service options to lower-income households, small businesses, and communities. The Community Reinvestment Act of 1977 created the Federal Reserve's community development function, which is tasked with promoting economic growth and financial stability for low- to moderate-income communities. Because CDFIs support access to credit in low- and moderate-income areas, the Federal Reserve has a direct interest in understanding CDFIs' role in capital access and the landscape of the industry. To accomplish this, the Federal Reserve Banks run a biennial survey of CDFIs led by the Richmond Fed that asks questions related to:

- Certification status

- Types of CDFIs and classifications

- Funding sources

- Primary and secondary business lines

- Demand for services

As we gear up for the 2025 Federal Reserve CDFI Survey, this post paints a picture of the current state of CDFIs and seeks to understand why the industry may look different than it did in 2023, our last survey year. There are several key takeaways:

- The number of CDFIs certified by the CDFI Fund has grown significantly over the last 15 years but decreased slightly since the last iteration of the CDFI Survey in 2023.

- Loan funds and credit unions make up the majority of certified CDFIs, both nationally and within the Fifth District.

- The types of financial institutions that are CDFI-certified has shifted significantly over time, especially as it relates to credit unions, which have doubled in the Fifth District and more than doubled nationally.

- Past survey results illustrate how differences in the business structures of CDFI credit unions and loan funds influence changes in demand and challenges in meeting demand.

These findings help us anticipate differences we might expect to see in this year's survey results, particularly when we look at results by CDFI type.

Certification

While CDFIs can be traced back to the 1970s, the number of CDFIs has grown significantly since the Riegle Community Development and Regulatory Improvement Act of 1994 established the U.S. Department of the Treasury's CDFI Fund, which led to the creation of a CDFI certification process.

The Federal Reserve CDFI Survey collects information from both certified CDFIs and noncertified mission-driven lenders. Due to sampling methods, the vast majority of CDFI Survey respondents have been certified or were progressing toward certification. While the Federal Reserve Banks conduct targeted outreach to certified CDFIs, CDFI member networks help reach noncertified mission-driven financial institutions.

Between 2011 and 2023, the number of certified CDFIs grew by 55 percent nationally and 30 percent within the Fifth District. However, the number shrank between 2023 and 2025 both in the Fifth District and in the nation. Some — if not all — of this decline is likely tied to the CDFI Fund's revised certification processes. Revisions were implemented to ensure that organizations are performing the required level of mission-driven lending to retain certification, and this revision process is ongoing. A policy and procedural review of certification processes was initiated in 2017, but the new application did not officially launch until December 2023. Some CDFIs might have missed the December 2024 deadline for submission and thus lost their certifications, if only temporarily.

The 2025 CDFI Survey will ask a question regarding the time and staff resourcing cost and value of CDFI certification. We are particularly interested in whether smaller, more staff-constrained CDFIs, or those with other distinct characteristics, perceive a higher cost to certification.

Breaking Down CDFI Industry Growth by Type

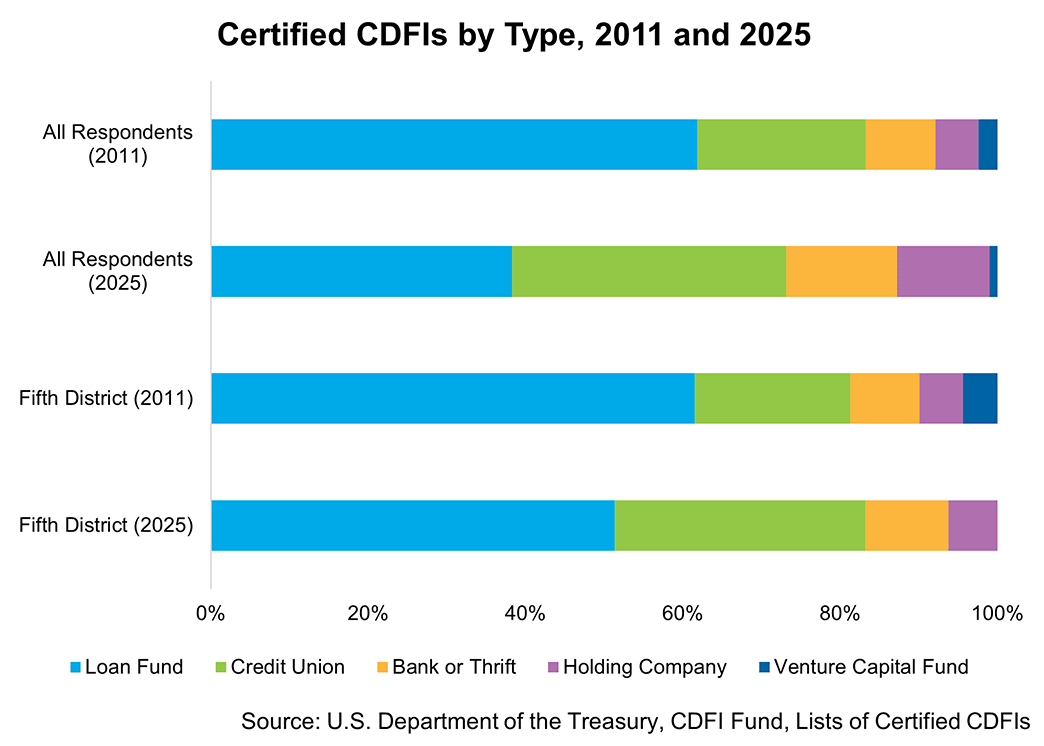

The majority of CDFIs are loan funds and credit unions; however, this breakdown has shifted notably in recent years, both nationally and within the Fifth District.

Prior to the revised certification process, loan funds and credit unions composed 75 percent of all certified CDFIs nationally and 84 percent in the Fifth District. While both organization types saw decreases in 2025, the number of CDFI-certified credit unions dipped further (8 percent) than loan funds (5 percent) nationally. In the Fifth District, both credit unions and loan funds dipped by 5 percent.

Change in CDFI Credit Unions

Between 2011 and 2025, the number of certified CDFI credit unions grew 134 percent nationally and doubled in the Fifth District. The most dramatic two-year increase took place from 2021-2023, when the number grew 49 percent nationally and 65 percent in the Fifth District.

As cooperatives, credit unions are member-owned and governed nonprofit organizations. Because of this business structure, they were able to arise as a powerful alternative to banks during the Great Depression. Growth in the overall credit union industry (not CDFI-specific) in more recent years was spurred by the Great Recession and a subsequent reduction in trust for banks. In the five years following the financial crisis, an estimated 13 million Americans switched to credit unions from larger banking institutions.

Several factors may help explain why this growth has translated to the creation and certification of more credit union CDFIs. Organizations such as Inclusiv — a CDFI that has created a large network specific to CDFI credit unions — provide credit unions with assistance and tools to become certified and maintain compliance. Cooperativas have also played a part in the rise of certified CDFI credit unions. Cooperativas are Puerto Rican cooperatives that offer a large range of services both inside and outside of the community development finance space.

Cooperativas contributed significantly to the national growth of CDFI credit unions from 2019 to 2023; cooperativas accounted for 32 percent of the near doubling in the number of CDFI credit unions. Cooperativas were also likely impacted by recertification application revisions, experiencing a 10 percent decrease from 2023 to 2025.

Change in CDFI Loan Funds

Although credit unions represent a larger percentage of CDFIs than in the past, loan funds are still the most common type of CDFI. While both are mission-driven lenders, CDFI loan funds have a very different business structure than CDFI credit unions. Arising primarily from the need for community investment in underbanked areas in the 1970s, loan funds do not accept deposits and have a place-based focus, while credit unions hold deposits and are more focused on individual members. Because of these differences, CDFI loan funds and CDFI credit unions tend to have very different business lines.

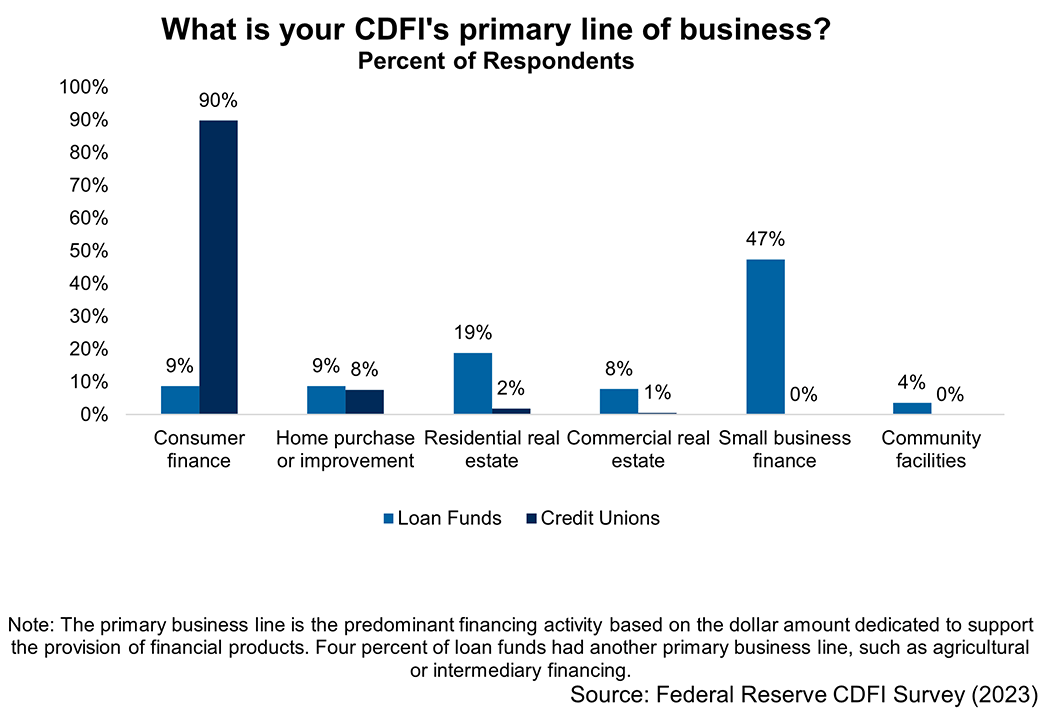

According to our 2023 CDFI Survey, CDFI credit unions primarily serve consumers directly (90 percent). Many loan funds, however, lend in areas such as small business financing (47 percent) and residential real estate development (19 percent). As a share of all CDFIs, loan funds have decreased notably — in 2011, they represented over 60 percent of all certified CDFIs nationally, but they now compose less than 40 percent. In the Fifth District, however, they still represent around 50 percent of all CDFIs.

How Different Types of CDFIs Meet Demand

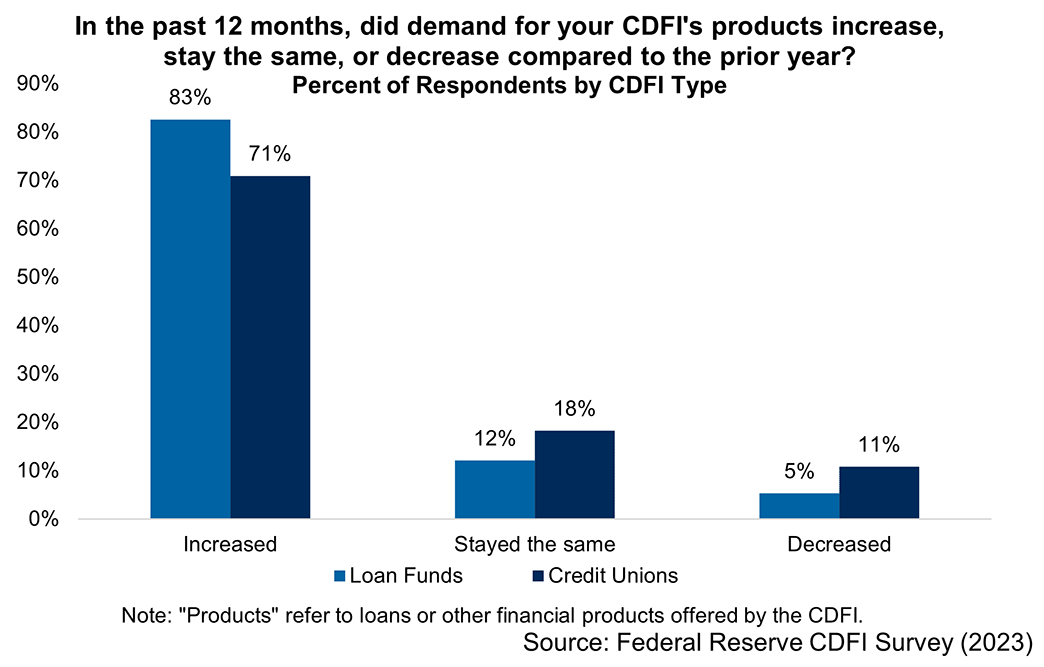

The differences in activity between these types of CDFIs can also be seen in the levels of demand they experience and how well they are able to meet it. Though most CDFIs saw an increase in overall demand, CDFI loan funds were more likely to see increases than were CDFI credit unions.

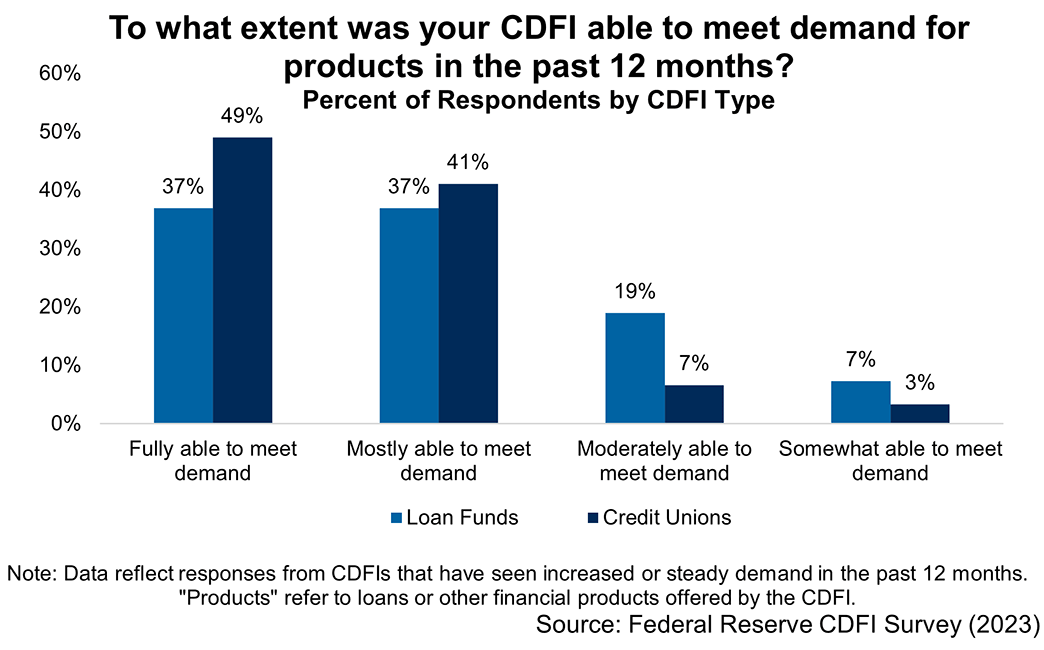

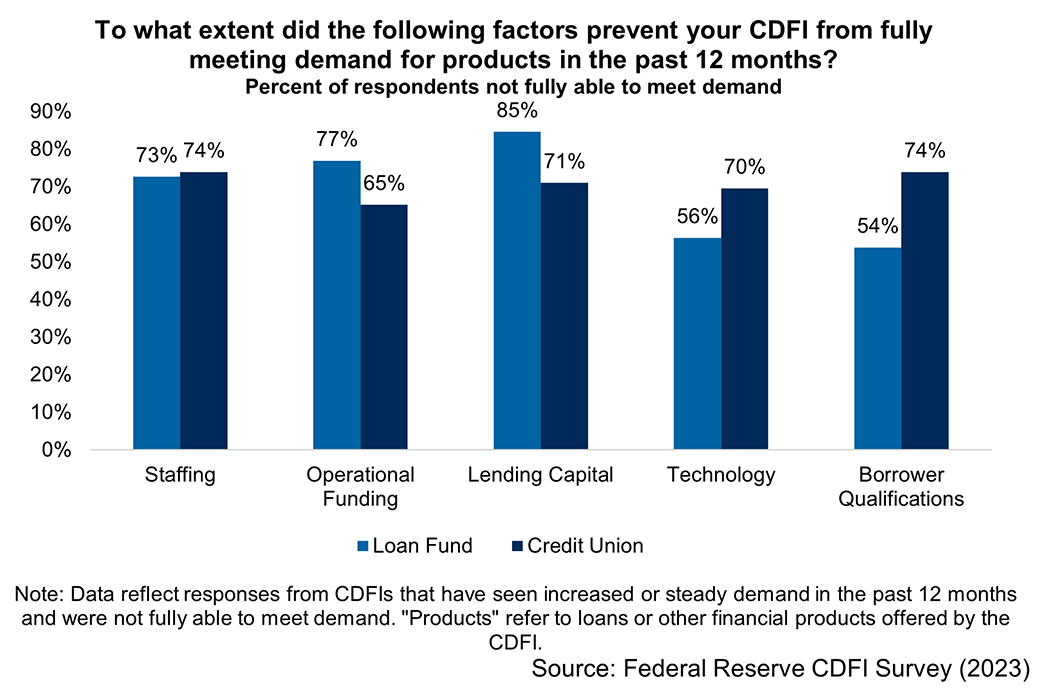

However, fewer CDFI loan funds were fully or mostly able to meet their overall demand than were CDFI credit unions. This could be related to the different challenges these types of CDFIs experience. CDFIs that responded that they were unable to fully meet demand were then asked a series of questions about what challenges they believed impaired that ability.

Funding and capital challenges are the most reported hurdles facing CDFI loan funds; as nondepository institutions, they do not hold deposits the way credit unions do and primarily source capital from banks, government programs, foundations, and other sources. Additionally, they are more restricted in how they use the capital they attain, and the cost of that capital can be higher than for depository CDFIs. Loan funds face fewer challenges related to borrower qualifications than credit unions, perhaps because they are dealing with fewer individuals and more organizations.

Conclusion

The insights provided by the 2023 Federal Reserve CDFI Survey offer valuable context as we head into the 2025 Federal Reserve CDFI Survey fielding period. We expect to see a strong representation of credit unions again this year, with loan funds potentially composing an even smaller portion of our sample than in 2023. We anticipate a continuation of the patterns we have identified around business lines, demand, and challenges that can be tied to a CDFI's business structure, and we hope that by using additional variables to explore these relationships on an even more granular level, we can better understand the intricacies of these structures.

Due to the fundamental differences in CDFI structures and changes in the industry composition of certified CDFIs, we will continue to report on the unique experiences of different types of CDFIs in this year's Key Findings Report. This year, we will be exploring new topics related to funding sources, organizational goals, and, as mentioned, costs (related to time and resources) and benefits of CDFI certification.

We highly encourage all CDFIs to use the 2025 Federal Reserve CDFI Survey as an opportunity to amplify their voices and be heard on a larger scale!

Views expressed are those of the author(s) and do not necessarily reflect those of the Federal Reserve Bank of Richmond or the Federal Reserve System.