Combatting Elder Financial Exploitation Awareness

Elder Financial Exploitation (EFE) is a growing threat. Here are some things to consider as part of your plans to identify and combat EFE.

On December 5, 2024, the Board of Governors of the Federal Reserve System, the Consumer Financial Protection Bureau (CFPB), the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA), the Office of the Comptroller of the Currency (OCC), state financial regulators and the Financial Crimes Enforcement Network (FinCEN) collectively issued an Interagency Statement on Elder Financial Exploitation designed to increase awareness and provide strategies to banking organizations for combatting EFE.i The statement is considered relevant for institutions with $10 billion or less in consolidated assets.

The interagency statement acknowledged that EFE is a growing threat, citing the 2024 National Money Laundering Risk Assessment (NMLRA), which indicated that EFE is an increasing money laundering threat and responsible for $3 billion in financial losses annually. The statement places emphasis on the FinCEN 2022 Elderly Financial Exploitation Advisory, which highlights typologies and red flags since the prior FinCEN 2011 advisory. While the statement is directed at guarding against EFE and provides examples of risk management practices, it’s not intended to set new compliance standards, regulatory requirements or supervisory expectations; but rather to raise awareness and provide strategies for combating elder financial exploitation.

Combatting EFE

There are several methods that a financial institution can take that can effectively aid in the identification, prevention and response to elder financial exploitations, including risk-based policies, internal controls, employee codes of conduct, ongoing transaction monitoring practices and complaint processes. Institutions may find that transaction holds or disbursement delays are effective measures against EFE. Additionally, procedures that allow for trusted contacts designated by account holders who are notified in the event EFE is suspected, may help mitigate EFE.

Policies and procedures related to the following should be developed:

- Training requirements and resources

- Reporting to appropriate entities and agencies

- Compliance with Regulation E

- Procedures for sharing account information with third parties

- Ongoing collaboration with external stakeholders

An effective training program increases the ability to recognize elder financial exploitation and should be integrated into the regular employee training cycle, including any new employee training.

The training program should include a specific definition of elder financial exploitation, potential indicators such as transaction pattern changes, identity theft and coercion, and behavioral changes. The program should be tailored for different staff roles and include situational examples of preventative measures that staff members can relate to.

Red Flags and Reporting Requirements

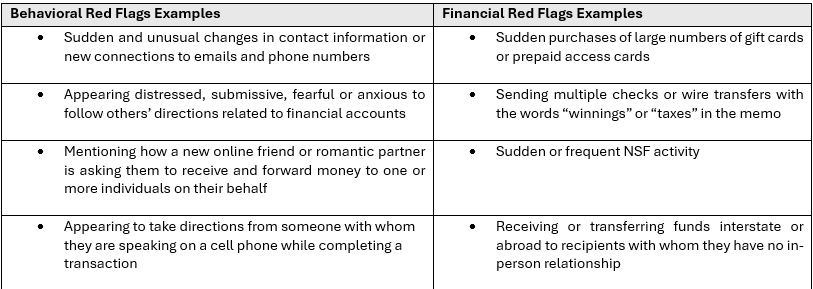

Elder financial exploitation may be identified by both behavioral and financial red flags associated with older customers.