CRA Program Growth Spurts: Navigating the Transition

Growing up feels like a rollercoaster. Sometimes you're soaring high during a growth spurt, and other times you're just trying to keep your feet on the ground.

While this statement resonates in many facets of life, its applicability to the Community Reinvestment Act evaluation process may not be as evident to some. That is, until they experience a “growth spurt” from small bank to intermediate small bank (ISB) or from ISB to large bank examination processes.

Differences between small bank, ISB and large bank examination procedures are significant, which is why in each Supervision News Flash this year, we’ll provide an overview of ISB and large bank procedures, CRA monitoring best practices and supporting documentation expectations that assist examiners in evaluating your bank’s performance. (Note: the articles in this series only speak to the existing CRA regulation and not the proposed modernized rule.)

To start the year off, we’ll cover ISB procedures and the two associated lending and community development tests; in future articles, we’ll cover the structure and components of large bank CRA procedures.

The Changing Landscape

Of the 203 banks headquartered in the Federal Reserve Bank of Richmond’s Fifth District —District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia — 83 (41%) are evaluated under the small bank CRA procedures, 75 (37%) are evaluated under the intermediate small bank (ISB) procedures and 45 (22%) are evaluated under the large bank procedures. As banks headquartered in the District continue to grow in assets over the next five years, a number of them will experience a transition to a different CRA evaluation process. Based on current asset sizes and growth rates, many banks will either transition from small bank to ISB or from ISB to large bank CRA procedures.

While there may be “growing pains” during some of those transitions, there is also an opportunity to plan and prepare for the transitions. Asset size thresholds for each of the examination procedures are updated annually and can be found here. The Federal Reserve Bank of Dallas has published A Banker’s Quick Reference Guide to CRA, which is a helpful resource when performing a CRA self-assessment.

Understanding Intermediate Small Bank Procedures

ISB procedures include two tests: the lending test and the community development test (CD test). If your bank was recently evaluated under the small bank procedures, the Lending Test should be familiar to you. It is comprised of five components: loan-to-deposit ratio, assessment area concentration, borrower’s profile, geographic distribution of loans and response to substantiated complaints. The good news is that those components remain exactly the same for ISB CRA evaluations.

The other test in an ISB CRA evaluation is the CD test, which is only comprised of one component: community development performance. See that’s not too scary, is it? This component considers the bank’s responsiveness to the community development needs of its assessment area(s) through loans, investments (including donations) and services. The current regulation and Interagency Questions and Answers Regarding Community Reinvestment are helpful resources to determine whether an activity qualifies under CRA’s narrow definition of “community development.”

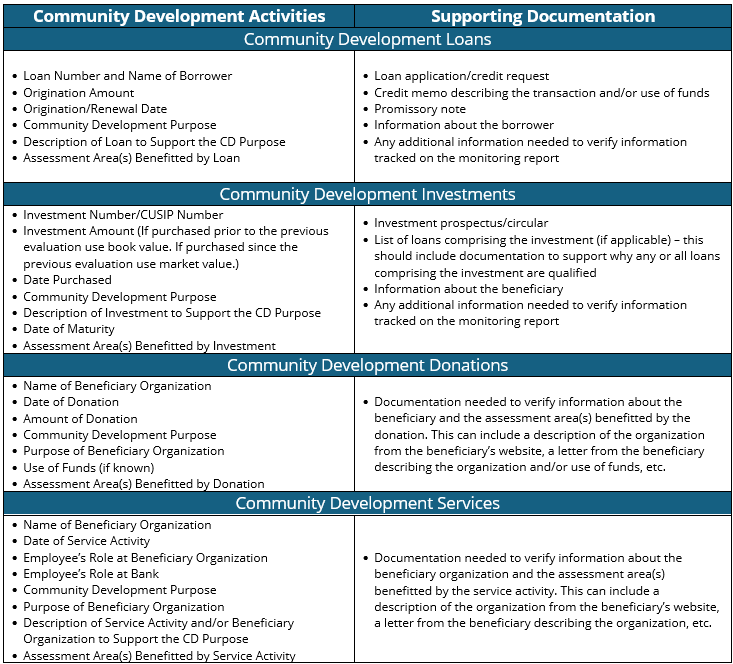

Once you’ve determined that an activity is qualified, the activity should be documented and tracked with specific pieces of information that support the activity. The marketplace has sophisticated CRA management platforms for banks with numerous assessment areas spanning multiple states; however, a well-developed spreadsheet can also be utilized for less-complex institutions as they transition to this evaluation standard.

Information to help track and monitor community development activities and performance is detailed in the following table; however, because each activity can be unique, the information and documentation standards listed below may not be exhaustive.