How Are Tariffs Impacting Firms?

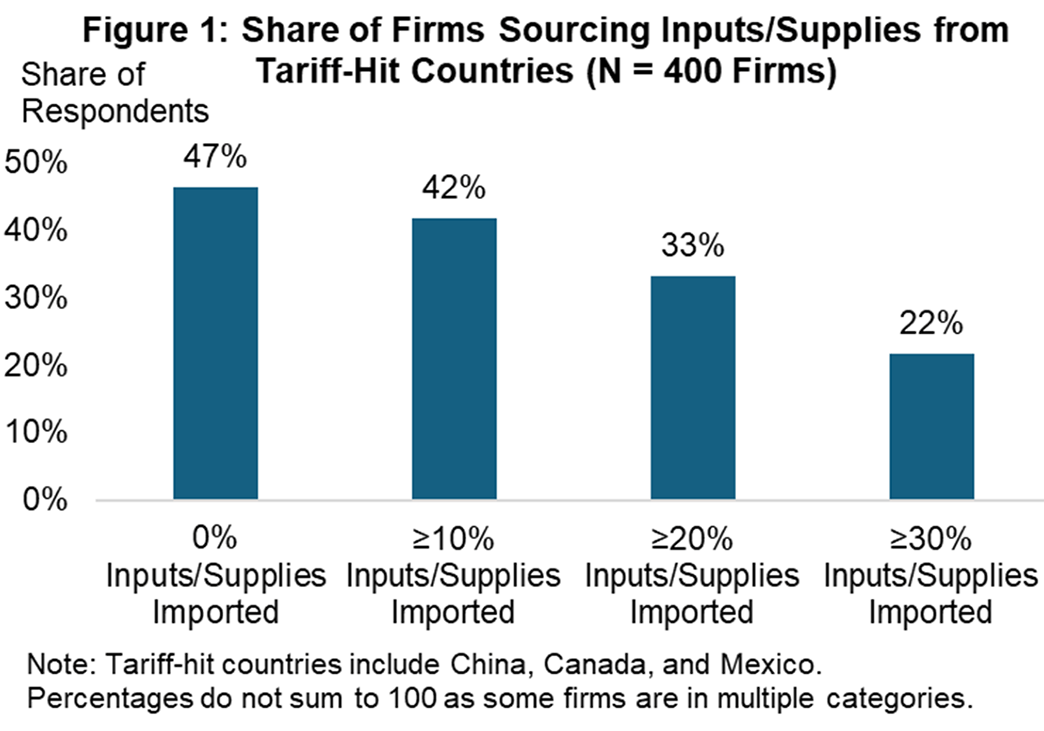

In the most recent CFO Survey, we explored the extent to which firms' inputs/supplies are imported from countries facing recently imposed tariffs1 and how this exposure impacts firms' expectations. Figure 1 shows that 53 percent of survey respondents reported sourcing some or most inputs/supplies for their firm's U.S. operations from China, Canada, and/or Mexico (i.e., tariff-hit countries). In the remainder of this post, we will examine how the expectations of firms that sourced their inputs/supplies from these three countries differ from those that did not, and whether the degree of reliance on these countries coincides with differences in firms' economic outlook and performance expectations.

Dimmer Economic Outlook Among Firms Exposed to Tariff-Hit Countries

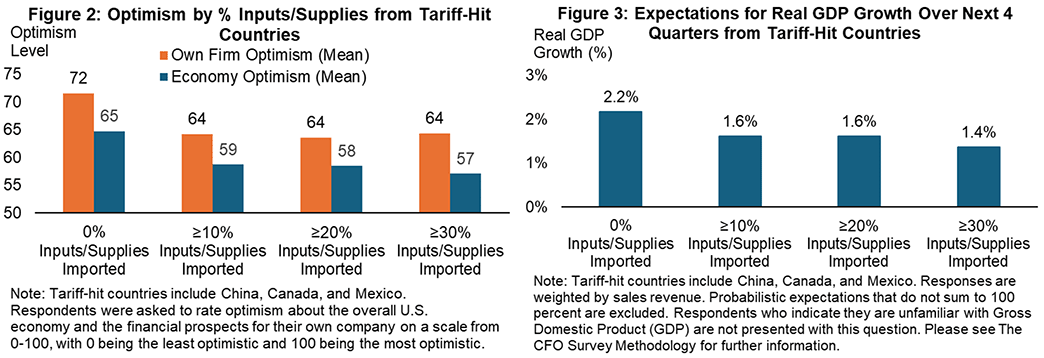

After firms broadly increased their economic and own-firm optimism and their GDP growth expectations last quarter, in Q1 2025 we observed a stark dichotomy between firms that relied on the countries hit hardest by tariffs for their inputs/supplies and firms that did not. Firms that sourced inputs/supplies from China, Canada, or Mexico were six to eight points less optimistic about the U.S. economy and eight points less optimistic about their own firm's prospects relative to their peers that did not import from these countries (Figure 2). Similarly, firms that sourced inputs/supplies from these countries expected real GDP growth in the next year to be 0.6 to 0.8 percentage points lower than their nonexposed peers (Figure 3). In both cases, whether or not firms sourced inputs/supplies from these countries — rather than the degree of reliance on these countries — appeared to account for much of the divergence.

Firms Exposed to Tariff-Hit Countries Expect Meaningful Impact on Performance

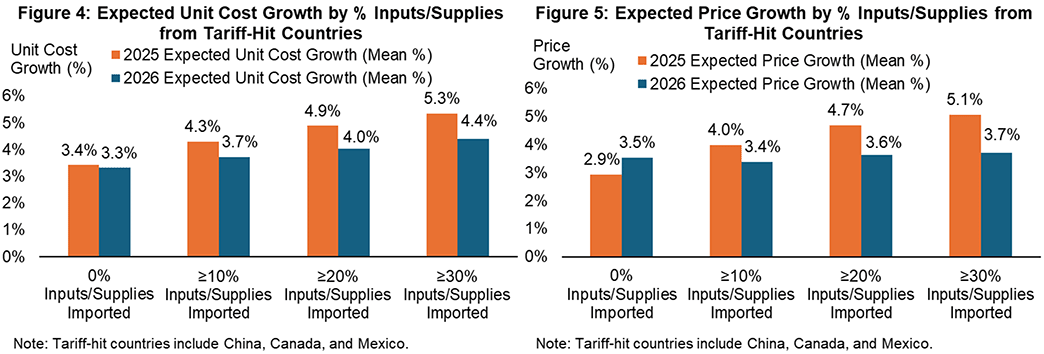

In addition to downgrading their economic outlooks, firms that sourced inputs/supplies from tariff-hit countries expected worse performance than their peers across most key metrics. Figures 4 and 5 demonstrate that the more firms imported inputs/supplies from tariff-affected countries, the higher their expected price and unit cost growth for 2025.

Looking ahead to 2026, firms that imported inputs/supplies from tariff-hit countries expected their unit cost expectations to remain elevated, but price growth is expected to be roughly similar across all firms. Respondents offered several potential explanations for this, including that they may attempt to offset higher unit costs by margin compression. As one firm noted, "tariffs will impact customers and expected inflation will create margin pressures."

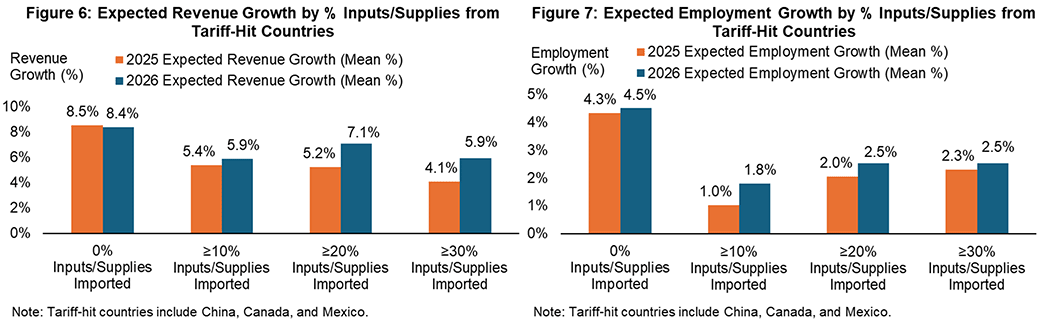

Firms that sourced inputs/supplies from tariff-hit countries also expected lower revenue and employment growth this year, with expected revenue growth declining as firms' reliance on tariff-hit countries increased (Figures 6 and 7). The divergence is expected to continue next year, though to a lesser degree. One respondent explained that with margins already compressed in their industry, revenue and employment may suffer because "potential tariffs [have] my industry worried about price escalation leading to cancelled projects."

Impact of Tariffs Similar on a Matched Sample Basis

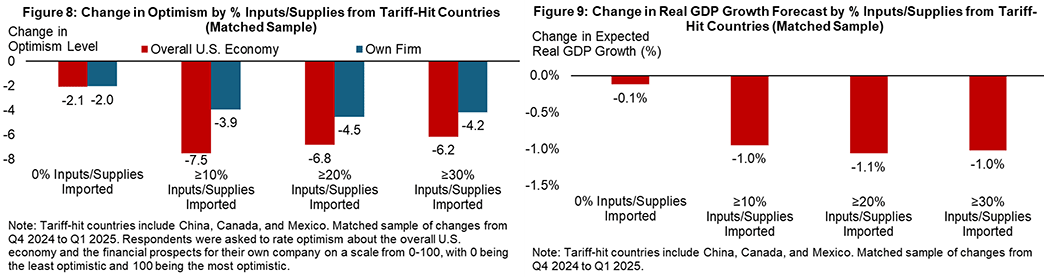

Finally, we examine changes in optimism, expectations for real GDP growth, and expected revenue, employment, cost, and price growth for the 282 firms that responded to both the Q4 2024 and Q1 2025 surveys. This analysis allows us to minimize the impacts of differences in sample composition between the two surveys. Figures 8 and 9 illustrate that compared to their peers, firms that relied on tariff-impacted countries to source their inputs lowered their optimism (economy-wide and own firm) and their expected GDP growth.

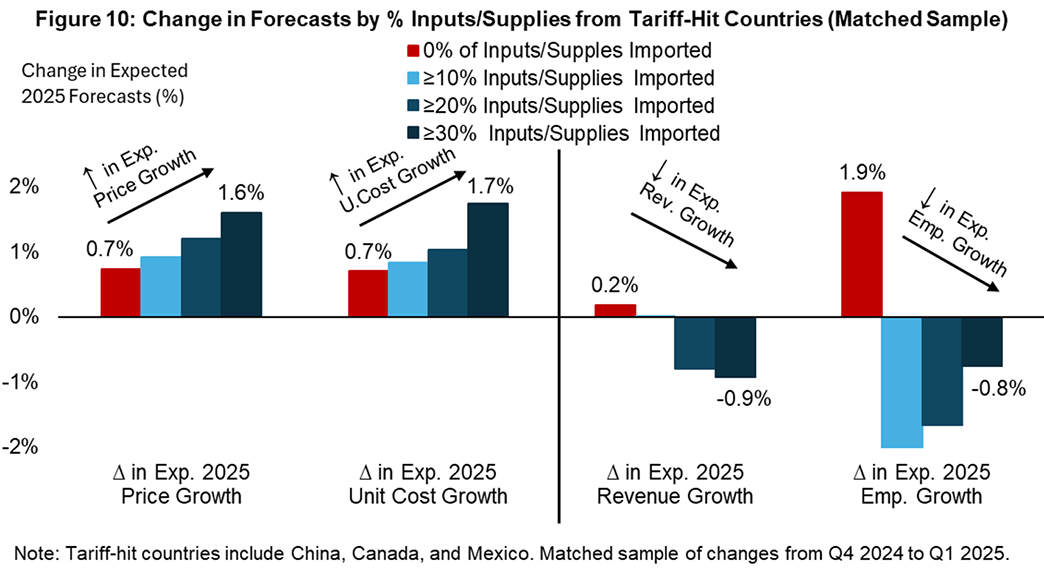

Furthermore, Figure 10 reveals sizeable differences in expected firm performance depending on whether firms sourced inputs/supplies from tariff-hit countries. Except for employment growth, expectations for price, unit cost, and revenue growth in 2025 were magnified for those firms sourcing higher shares of their inputs from tariff-hit countries. These results suggest that tariff-related concerns are likely the cause of the divergence in firms' performance expectations.

Conclusion

Just over half of the firms in our sample source inputs/supplies from China, Canada, and/or Mexico and are thus directly exposed to the tariffs recently imposed on these countries. Relative to their nonexposed peers, these firms became less optimistic, expected lower revenue and employment growth, and expected higher price and unit cost growth — with only price growth expected to stabilize by 2026. In addition to the sizeable impact on firms' prospects, financial decision-makers have also highlighted considerable uncertainty surrounding the breadth and duration of tariffs and the attendant consequences for their firms. We will look to future surveys to inform how financial decision-makers' views evolve on the expected impact of tariffs on their firms and the U.S. economy.

Our analysis exclusively focuses on firms' exposure to China, Canada, and Mexico because tariffs had been announced and implemented for these specific countries in the period leading up to and during the survey fielding period. As a result, while the survey question also asks for the percent of inputs/supplies that firms sourced from "Other" countries, we leave this category aside for the present analysis.

Receive an email notification when The CFO Survey updates are posted online.